Serving Pasco County, Spring Hill Area, New Tampa, and Surrounding areas | 1-833-519-POOL (7665)

Swimming Pool Loans

for Good & Bad Credit

Frequently Asked Questions

About Acorn Finance

Get personalized rates for pool loans in

60 seconds without impacting your credit

score in any way.

How much would you like to finance?

OR

What are Acorn Finance’s credit requirements?

Acorn Finance is an online lending marketplace where you can easily compare rates and monthly payments from different lenders without impacting your credit score. Anyone can check for offers on Acorn Finance.

However, each lender that participates on the Acorn marketplace has a specific set of credit requirements that helps them determine, based on risk, who to lend money to. These requirements typically includes things like:

Your credit score

Your employment status and income level

Your credit history

Your debt-to-income ratio (lenders typically look to see if your outstanding debt obligations plus any new debt can be supported by your income so they can evaluate how likely it is that you will be able to repay the loan)

Generally speaking, the minimum credit score our lenders consider is around 560. They also look at other information from your credit report to determine your eligibility for a loan. For example, if you have a recent bankruptcy filing or have missed payments on loans or credit cards within the past few years, the lenders may not provide offers.

If your credit history is challenged, adding a co-borrower (such as a parent or spouse) with a stronger score can help.

This chart shows how lenders generally view different credit score ranges in terms of risk level:

OR

Frequently Asked Questions

What is Acorn Finance?

Acorn Finance is a lending marketplace where the nation’s top online consumer lenders pre-qualify customers for personalized loan options in 60 seconds, with no impact to their credit score. Acorn Finance uses an initial soft credit inquiry to provide access (for eligible individuals) to competitive loan offers through a fast and easy online process.

Is Acorn Finance legit?

Acorn Finance is an accredited, safe, and secure business headquartered in Sacramento, California. We have an A+ rating at the Better Business Bureau and excellent ratings on TrustPilot. We receive thousands of requests each month from people checking for pre-qualified loan offers from our network of top lenders.

Acorn Finance has been issued licenses and registrations in these states.

You can also find us at the Nationwide Multistate Licensing System (NMLS).

*NOTE: The original name of our company was Headway Sales Inc. We changed it to Acorn Finance because we partnered with a commercial lender called Headway

Capital and wanted to avoid confusion.

Please reach out to our Support Team with any additional questions: 916-404-1982

Does Acorn Finance have a phone number to call?

Yes, our number is: 916-404-1982

Where can I find the Acorn Finance login for Contractors?

Contractors: https://my.acornfinance.com/sign-in

Borrowers Access Offers Page: https://www.acornfinance.com/access-offers

What are Acorn Finance’s interest rates?

Acorn Finance is not a lender, so it does not set interest rates on loans. The lenders that participate on the Acorn loan marketplace have specific sets of credit requirements that help them determine, based on risk, who to lend money to and what interest rates to charge.

Interest rates are calculated based on a lender’s assessment of the credit risk of the borrower. To determine this, the lender may consider factors including:

Your credit score

Your payment history on credit cards and loans

Your debt-to-income ratio

The length of time you have been using credit

Does Acorn finance require a minimum credit score to check offers?

There is no minimum credit score requirement to check offers on Acorn Finance. Using your submitted application information and a soft credit check, our network of lenders will evaluate your loan request in seconds to see if you are pre-qualified for offers.

Each lender has an established underwriting formula and typically includes factors such as your credit history, your current debt-to-income ratio, and your employment status in determining your creditworthiness and what offers you qualify for.

How can first time home buyers use Acorn?

First time homebuyers can use Acorn a few different ways:

If you just purchased a new home and it needs interior remodeling, exterior remodeling, or any other kind of home improvement work done, you can check for financing offers on Acorn

If you need additional cash for a down payment on the house, you may be able to use a personal loan

Is there an Acorn Finance app?

Acorn Finance has a web-based app. You may save the portal link to the home screen of your mobile device. Once you have it on your device, it works like any other app.

Using your mobile device, go to https://my.acornfinance.com/sign-in and sign in.

This will open the portal on your phone. Then you can save it to your home screen.

Instructions to download the app are different for iPhone and Android:

What is Acorn Finance for contractors?

Acorn Finance is a financing platform for contractors, with no dealer or subscription fees. Our marketplace of lenders can serve a broad range of borrowers with a variety of credit needs.

Does Acorn Finance offer business loans?

Business loans are available on the Acorn Finance marketplace. You can receive business loan offers through Acorn Finance’s quick and simple pre-application online process. Our platform works with 28 business lenders to help you find the best lending products for your business.

Is there an Acorn mortgage program available?

Acorn Finance does not currently have mortgage offers available on the marketplace. However, second mortgages (also known as second liens, junior liens, or home equity loans) are available in select states.

Is Acorn Finance available in all US states?

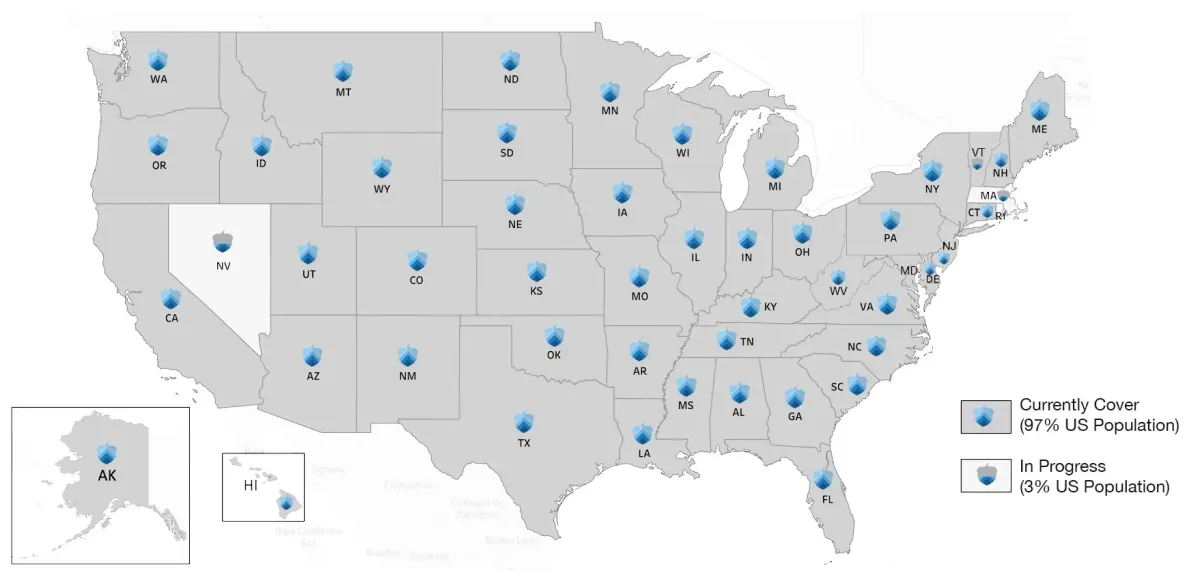

Acorn Finance currently covers 97% of the U.S. Population. If your state is one of the 3 states that are not covered namely, Massachusetts, Nevada and Rhode Island then please be patient as we’re in the process of obtaining licenses in these remaining states. However, due to COVID-19, the state licensing application process is delayed.

State Coverage Map

Acorn Finance currently covers 97% of the U.S. Population. If your state is one of the 3 states that are not covered namely Massachusetts, Nevada and Rhode Island then please be patient as we’re in the process of obtaining licenses in these remaining states. However, due to COVID-19, the state licensing application process is delayed.

Easy Swimming Pool Financing Near Me - No Hard Credit Check OK

A new pool is an investment, and not cheap. We know when you’re looking to finance your pool, it can be overwhelming.

That is why Acorn puts you in control by showing you personalized pool loan offers from lenders in our network, with no impact to your credit score.

You can easily sort the pool financing offers based on what’s most important to you: interest rate, payment amount, or length of the loan.

Our 100% online, customer-friendly process is designed to help you find cheap payment options with trusted lenders that can finance your new pool.

OR

The Pool Cleaning Pros with the Sparkling Reputation.

We take pride in providing refreshing service that leaves a lasting impression.